All about Partnership Registration

Partnership Registration

A partnership is form of business in which 2 or more 2 persons can come together to run business together. Unlike proprietorship form of business where single owner suffers a lot of limitations, such as limited resources in terms of finance to business, limited skill of management and control by the owner and unlimited liability levied on single person in sole proprietorship. With time as business grows it required more capital more resources in term of owner involvement and a proprietor finds him unable to fulfill these requirements. So, the person of like minded will come together to form a business and run together in partnership

We can understand this thing by simple example Mr. A who is technically equipped person in Information technology but they don’t run sales well in comparison to their Peer, while MR b who is having good skills in sales but lack of knowledge in information technology, now they both can come together to form an organization under partnership act.

A p[partnership is considering a good option to run business in comparison to Private limited or Limited liability firm because it is less costly to form as well as it required less compliance to follow once it formed. A partnership just formed on stamp paper by the partner on framing all the terms and condition to run their business followed by notarized by notary, the value of stamp per to form a firm is different according to state stamp act.

Further a partnership is divided in to Two categories:

- Registered Partnership firm: Under Registered partnership firm once firm formed by signing stamp papers by all the partner is must be registered under state act, and by having your firm registered you can make liable anyone if they don’t pay their debts by filled suit against firm as well firm can setoff any liability if anyone filled suit and they also have dues against firm.

- Unregistered Partnership firm: An unregistered partnership had a following disadvantage as discussed in registered firm like they can filled a claim of suit against third party against the dues nor they can set off any liability against there dues.

LIMITED LIABILTY PARTNERSHIP: There are another form of partnership which have limited liability which remove the constraint of unlimited liability unlike general partnership, here partners are liable up to the extent of capital and there retained profits available in their business.

Contact us

Reasons for Limited Liability Partnership

Documents Required for Partnership registration

1. Pan Card

Individual PAN card of all partners are required for registration. In partnership firm separate PAN card will applied after partnership deed.

2. Aadhar Card

For Partnership registration we need Adhaar card of all partners ( Some time Voter ID may work ) for address of individual

3. Photograph

A passport size photograph is required of every partner

4. Business address proof

For business address proof we need Electricity bill, rent agreement or any other government utility bill.

Reasons for Sole Partnership

1. Easy to start

For starting partnership firm there is some basic requirements only, we only need two partners who come together for running business for profit or loss. The firm can be register by simple deed execution and application of PAN card.

2. Good for small business

Small business person who don't want to invest more for legal proceedings can apply for partnership registration.

3. Low budget process

Some stamp papers according to state provision in which firm to be register is required, generally stamps required upto 1000/- Rs for all states of India.

4. No annual cost

Partnership firm does not have any annual compliance cost like other business entities, Only income tax return filling of firm is required.

5. Different Name

In partnership firm we can choose any name for firm registration, it is suggestible to consider Trademark while selecting name for partnership firm.

REGISTRATION PROCESS

Step-1

Expert advice

Get a call from expert so as they can understand business

Step-2

Documents submission

Send all the documents according to your business requirement as suggested by the expert.

Step-3

Terms and conditions

Partner will decide all the terms and conditions of partnership like profit ratio, name etc

Step-4

Application filling

Once all the documents been send by you our team filled the application to the relevant department.

How Ovakil help in partnership registration ?

ovakil helps you for registering partnership business,it usually take 2-3 days for all process

1. Deed formation

For partnership firm we need deed to be print on stamp and properly notarized. We provide customize deed preparation and notarization.

2. GST Registration

This registration will take 2-3 days and GST registration is sufficient to open current account for business

3. Udhyog Adhaar Registration

Udyog Aadhaar is a registration for all micro, small and medium sized businesses. This registration along with a GST registration can be used for opening of bank account.

3. Partnership Deed

LLP deed is important for every LLP, we will prepared after understanding your business needs.

FAQs

A Partnership is an association of two or more person who work together towards common goal and objectives and shares the profit and losses in accordance to the partnership deed.

It is close ended form of business under firm only Partners can only work, it a low cost model and lesser legal requirements of business in comparison to Company and LLP.

No, under Partnership, there is no separate legal entity both partners and firm are seen same, unlike company where members and company are treated to separate legal entity.

Under Partnership there is minimum 2 partners and maximum no partners is 10 in case of banking business and 20 in case of any other business.

No, under Indian Partnership act 1932, for forming partnership there is no requirement of registration of partnership.

Latest from the blog

Check In Which Class Your Trademark Is To Be Registered

Trademark registration that works to protects your business reputation and goodwill around the world. With the trademark; one can easily make his or her business

Some Reasons For Trademark Objections

Once a Trademark application is filed, a trademark examiner scrutinizes the application. This is done to make sure the application isn’t at odds with any trademark

Rules for Authorized Share Capital for Company Registration

Authorized Share Capital more commonly known as authorized capital is basically the maximum amount of share capital that a company can issue to shareholders. This amount

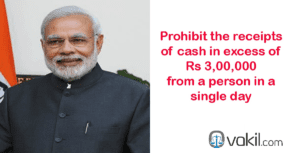

Transaction In Cash Above Rs 3 Lakhs Is Prohibited In India

From this budget a new Section 269ST is proposed to prohibit the receipts of cash in excess of Rs 3,00,000 from a person in a

Pre-Assessment Notice To Wrong Address of Assessee Will Not Render A Valid Notice

In CIT v. Abacus Distribution Systems (India) Pvt. Ltd, the Bombay High Court held that the issue of a notice under section 143(2) of the Income

Nidhi Company Registration process and list of documents required

Nidhi Company registration process isn’t extremely tough and not take much time to entire procedure. To continue with the idea of company, we like to give

PACKAGES

sILVER

all inclusive fees-

PAN

-

DEED DRAFTING

-

MSME Registration

-

Expert Advice

-

GST Registration

-

Registration of Firm

GOLD

all inclusive fees-

PAN

-

DEED DRAFTING

-

MSME Registration

-

Expert Advice

-

GST Registration

-

Registration of Firm

Platinum

all inclusive fees-

PAN

-

DEED DRAFTING

-

MSME Registration

-

Expert Advice

-

GST Registration

-

Registration of Firm

All over india services provider

Why to choose ovakil?

Faster services

We provide faster services, we had a team of professional who provide services to you 7 days a week.

free cousultancy

Our Team is just one call away to provide solutions to your all tax querries at free of cost.

team of CA, CS & LLB

We had a huge team of experienced Professionals CA,CS, LLB and Tech experts.

Lowest price

We provide our services to our costumers at lowest price in INDIA

We are Very Glad to Know Our Client Reviews