All about section 8 company Registration

A person who wants to open a non –profit organization has two options either they can form a trust or we can say NGO registration or can open section 8 company registration under company act, it is similar to NGO , in terms of there working and features the difference point both are registered under different act. its a complete online process

Requirements of incorporation of section -8 company/ NGO Registration Process:

- There must be 2 director who can also be shareholder required for forming the company, however there will be no limit for maximum director

- There is no minimum capital requirement for opening of NGO/ section company

- The objective of company should be charitable purpose like education, medical aid, sports, cultural activity etc.

It can claim advantage of tax exemption by registering itself under section 12aa of income tax act, also 80G where donors can also claim exemption under its personal income tax filling if organization is also registered under section 80 G.

DIIFERENCE BETWEEN SECTION-8 COMPANY AND NGO REGISTRATION UNDER TRUST/ SOCIETY REGISTRATION:

- : NGO registered under society/ Trust act while section-8 company registered under company act.

- An NGO is registered in a respective state while a section -8 company register under ministry corporate affairs.

- Generally an NGO registered wok in respective state while section 8 company can work all over India.

- Registration of section-8 company is a online process there is no physically presence required, while registration of NGO under trust/ society required some physical presence.

- Registration of NGO required 10-15 days while section -8 company will registered with in 3-4 days.

- Fees of registering section company is only 9999rs, while a trust can form 10000-15000 rs India.

Contact us

Documents Required for section-8 company/NGO

1. Pan Card

Individual PAN card of all proposed directors/ shareholders are required for registration. In partnership firm separate PAN card will applied after partnership deed.

2. Aadhar Card

For registration under section-8 we need Adhaar card of allproposed directors/ shareholders for address of individual

3. Photograph

A passport size photograph is required of every proposed directors/ shareholders

4. address proof

For business address proof we need Electricity bill, rent agreement or any other government utility bill. ( not older than 2 months)

5. bank sattement

Bank Statement for business authentication or the proof of permanent address. ( not older than 2 months)

why section 8 company...??

1. Easy to start

For starting Section -8 company u need only 2 person awho works for common objective of social welfare can form section 8 company.

2. Better option for social organisation

In comparison to NGO or Society Section -8 company would be considered as better option.

3. Esay to apply 80 g/ 12aa license

Once you have taken Section -8 company registration you can apply for tax benefits in income tax u/ 80 G or 12 AA.

4. MInimum annual cost

Unlike other social organization section 8 company requires minimal annual compliances

5. ELIGIBLE FOR CSR GRANT

Section -8 company is eligible for corporate grants under there CSR ( corporate social responsibility) program.

REGISTRATION PROCESS

Step-1

Expert advice

Get a call from expert so as they can understand business

Step-2

Documents submission

Send all the documents according to your business requirement as suggested by the expert.

Step-3

Documnets filling

After collection of all documents our expert will prepared form according to it and filled the same

Step-4

Incorporation certificate

Once all the documents has been filled you will get your certificate with in 7-8 days.

How Ovakil help in section 8 company registration ?

ovakil helps you for registering section 8 company, it usually take 7-8 days for all process

1. COMPANY INCORPORATION CERTIFICATE

We will provide company incorporation certificate after all process, this certificate is important for every company and required as a proof of company registration

2. SHAREHOLDERS/ DIRECTORS DSC AND DIN

This registration will take 2-3 days and GST registration is sufficient to open current account for business

3. PAN AND TAN

Permanent account number (PAN) and Tax allocation number (TAN) will be provide by us in this registration.

4. MOA AND AOA CREATION

Memorandum of association (MOA) and Article of association (AOA) will prepared after understanding your business needs.

FAQs

There is no requirement of minimum capital in case of section 8 companies

There is no physical presence required for forming section-8 company/ trust, forming of section-8 company/ NGO is online process.

Registration of NGO in trust / society act is governed by respective state laws, while registering section-8 company/ NGO under company act is governing by central las that company act 2013.

Pan card, adhaar card, picture, latest bank statement and one utility bill for address proof.

Yes only charitable object can perused in section 8 companies like helping poor, medical assistance for needy, society welfare, culture promotion, sports promotion etc

Once a section-8 company/ NGO registration process is complete, the organization can apply tax exemption license like 80g/12aa wheresection-8 company/ NGO get exemption for there receipts also donor will get tax benefits while filling there return.

With ovakil.com You can get sevtion-8 company license/ NGO only on 9999rs

Latest from the blog

Check In Which Class Your Trademark Is To Be Registered

Trademark registration that works to protects your business reputation and goodwill around the world. With the trademark; one can easily make his or her business

Some Reasons For Trademark Objections

Once a Trademark application is filed, a trademark examiner scrutinizes the application. This is done to make sure the application isn’t at odds with any trademark

Rules for Authorized Share Capital for Company Registration

Authorized Share Capital more commonly known as authorized capital is basically the maximum amount of share capital that a company can issue to shareholders. This amount

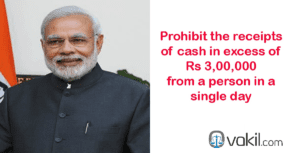

Transaction In Cash Above Rs 3 Lakhs Is Prohibited In India

From this budget a new Section 269ST is proposed to prohibit the receipts of cash in excess of Rs 3,00,000 from a person in a

Pre-Assessment Notice To Wrong Address of Assessee Will Not Render A Valid Notice

In CIT v. Abacus Distribution Systems (India) Pvt. Ltd, the Bombay High Court held that the issue of a notice under section 143(2) of the Income

Nidhi Company Registration process and list of documents required

Nidhi Company registration process isn’t extremely tough and not take much time to entire procedure. To continue with the idea of company, we like to give

PACKAGES

sILVER

all inclusive fees-

PAN / TAN

-

MOA / AOA

-

NGO REGISTRATION

-

2 DSC

-

2 DIN

-

EXPERT ADVICE

-

MSME REGISTRATION

-

GST REGISTRATION

GOLD

all inclusive fees-

PAN / TAN

-

MOA / AOA

-

NGO REGISTRATION

-

2 DSC

-

2 DIN

-

EXPERT ADVICE

-

MSME REGISTRATION

-

GST REGISTRATION

Platinum

all inclusive fees-

PAN / TAN

-

MOA / AOA

-

NGO REGISTRATION

-

2 DSC

-

2 DIN

-

EXPERT ADVICE

-

MSME REGISTRATION

-

GST REGISTRATION

All over india services provider

Why to choose ovakil?

Faster services

We provide faster services, we had a team of professional who provide services to you 7 days a week.

free cousultancy

Our Team is just one call away to provide solutions to your all tax querries at free of cost.

team of CA, CS & LLB

We had a huge team of experienced Professionals CA,CS, LLB and Tech experts.

Lowest price

We provide our services to our costumers at lowest price in INDIA

We are Very Glad to Know Our Client Reviews