All about INCOME TAX RETURN

INCOME TAX RETURN

As per Income tax act every person whose taxable income exceeds the basic exemption slab would required to get there income tax return filled mandatory. This income can be any source weather coming from business , alary rental income, interest income or can be any source is is mandatory for every individual to get there return filled with in due date.

NOW FIRST WE UNDERTAND WHEN A PERSON IS REQUIRED TO FILLED INCOME TAX RETURN MANDITORY?

- If turnover from your business exceeds 60 lacs during the financial year.

- If income from profession exceeds Rs 10 lakh during the financial year.

- Total of TDS and TCS during the last financial year is Rs 25,000 or more (for senior citizen limit is 50000pa)

- Total deposits in your all savings bank accounts weather in one or mare banks are Rs 50 lakh or more during the last financial year.

- If in your current account you deposit more then 1 crore during last financial year

- If on foreign travel you have incurred expenditure for 2 lacs or more either for himself or also for the person accompanied you.

- If you pay electricity bill of rs 100000 or more for all your electricity connections during the year.

- If your income before allowing any deduction (u/s 80c to 80u) exceeds Rs 2.5 lakhs in FY 2020-21. For senor citizen the limit is 3 lacs for super senior the limit is 5 lacs p.a

- You want to claim an income tax refund because you don’t have any income tax liability and TDS has been deducted by the deductor.

Contact us

Documents Required for Incometax registration

1. Pan Card

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

2. Aadhaar Card

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

3. Saving Bank Details

Bank account details is required for registration. We need Passbook first page and latest statement. Also provide us Bank account number, IFSC code and Branch name

4. Business address proof

For business address proof we need Electricity bill, rent agreement or any other government utility bill

Reasons for INCOMETAX RETURN

1. mendetory to file above 250000/-

It is mandatory to file Income Tax return for those who have annual income above 250000 in the financial year

2. to clame your TDS refund

If your income is less than your refund than you can file your return and clime TDS refund

3. for approval of loan

It is mandatory to file income tax for loan approval

4. proof of income

It is mandatory to file income tax return for the proof of your income in front of government

5. deposited more than 50,00,000 in saving bank account

If you deposited more than 50,00,000/- INR in your saving bank account in the financial year than it is mandatory to file income tax return

6. if your tds is more than 25000/-

if your TDS return is more than 25000/- INR during the financial year so you have to file income tax return.

PROCESS

Step-1

Creating login

First step is create your income tax LOGIN on the government sire

Step-2

Verification

After creating successfully LOGIN you have to verify your indentification through Aadhar verification

Step-3

preparing return

Now you have to prepare your return for filling

Step-4

File return

Final step to is to file your income tax return on Government Portal

How Ovakil help with INCOME TAX FILLING ?

Ovakil helps you for Filling your income tax return

1. Registration

OVAKIL HELPS YOU TO REGISTER YOUR PAN CARD ON INCOME TAX PORTAL.

2. creating/preparing return

We prepare your return with the best knowledge of our team on the bases of the documents send by you.

3. filling return

OVAKIL helps you to file your Income Tax

4. Expert Advice

We Provide you free expert advice regarding your income tax return and refund also

FAQs

It is a tax levied by the Government of India on the income of every person. The provisions governing the Income-tax Law are given in the Income-tax Act, 1961.Through the above article, we can recommend you the latest dresses.Shop dress in a variety of lengths, colors and styles for every occasion from your favorite brands.

The revenue functions of the Government of India are managed by the Ministry of Finance. The Finance Ministry has entrusted the task of administration of direct taxes like Income-tax, Wealth tax, etc., to the Central Board of Direct Taxes (CBDT). The CBDT is a part of Department of Revenue in the Ministry of Finance.

CBDT provides essential inputs for policy framing and planning of direct taxes and also administers the direct tax laws through the Income-tax Department. Thus, Income-tax Law is administrated by the Income-tax Department under the control and supervision of the CBDT.

Income-tax is levied on the annual income of a person. The year under the Income-tax Law is the period starting from 1 st April and ending on 31 st March of next calendar year. The Income-tax Law classifies the year as (1) Previous year, and (2) Assessment year.

The year in which income is earned is called as previous year and the year in which the income is charged to tax is called as assessment year.

e.g., Income earned during the period of 1 st April, 2015 to 31 st March, 2016 is treated as income of the previous year 2015-16. Income of the previous year 2015-16 will be charged to tax in the next year, i.e., in the assessment year 2016-17.

Taxes are collected by the Government through three means: a) voluntary payment by taxpayers into various designated Banks. For example, Advance Tax and Self Assessment Tax paid by the taxpayers, b) Taxes deducted at source [TDS] from the income of the receiver, and c) Taxes collected at source [TCS]. It is the constitutional obligation of every person earning income to compute his income and pay taxes correctly.

Generally, the tax on income crystallizes only on completion of the previous year. However, for ease of collection and regularity of flow of funds to the Government for its various activities, the Income-tax Act has laid down the provisions for payment of taxes in advance during the year of earning itself. It is called as ‘pay as you earn’ concept. Taxes may also be collected on your behalf during the previous year itself through TDS and TCS mode. If at the time of filing of return you find that you have some balance tax to be paid after taking into account the credit of your advance tax, TDS & TCS, the shortfall is to be deposited as Self Assessment Tax.

Latest from the blog

Check In Which Class Your Trademark Is To Be Registered

Trademark registration that works to protects your business reputation and goodwill around the world. With the trademark; one can easily make his or her business

Some Reasons For Trademark Objections

Once a Trademark application is filed, a trademark examiner scrutinizes the application. This is done to make sure the application isn’t at odds with any trademark

Rules for Authorized Share Capital for Company Registration

Authorized Share Capital more commonly known as authorized capital is basically the maximum amount of share capital that a company can issue to shareholders. This amount

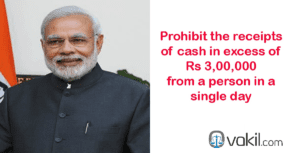

Transaction In Cash Above Rs 3 Lakhs Is Prohibited In India

From this budget a new Section 269ST is proposed to prohibit the receipts of cash in excess of Rs 3,00,000 from a person in a

Pre-Assessment Notice To Wrong Address of Assessee Will Not Render A Valid Notice

In CIT v. Abacus Distribution Systems (India) Pvt. Ltd, the Bombay High Court held that the issue of a notice under section 143(2) of the Income

Nidhi Company Registration process and list of documents required

Nidhi Company registration process isn’t extremely tough and not take much time to entire procedure. To continue with the idea of company, we like to give

PACKAGES

All over india services provider

Why to choose ovakil?

Faster services

We provide faster services, we had a team of professional who provide services to you 7 days a week.

free cousultancy

Our Team is just one call away to provide solutions to your all tax querries at free of cost.

team of CA, CS & LLB

We had a huge team of experienced Professionals CA,CS, LLB and Tech experts.

Lowest price

We provide our services to our costumers at lowest price in INDIA

We are Very Glad to Know Our Client Reviews