Annual compliance for Private limited company

Private Limited Annual compliance

Annual compliance for Private limited includes filling of annual accounts and annual reports to government common known as MCA/ ROC, it is mandatory for every private limited company to get there annual accounts audit of there books of accountant from a chartered accountant and filled the same to ROC there annual forms like AOC-4, MGT-7, DPT-3, ADT-1 etc

Every company should hold minimum 4 board meetings its is mandatory to hold board meeting and there is no maximum limit of board meeting, apart form there is a mandatory requirement to hold Annual general meeting once in a year.

Now question which company is required to get there accounts audit?

Every company weather its not having any turnover or having turnover 1 cr is required to get there accounts audit from a chartered accountant and filled the same to ROC.

Which form is required to filled in Private Company Annual compliance ?

Some of the common form required to filed by the company every year:

1. AOC-4: Under this company is filled the financial statement in AOC-4, attachments like balance sheet, board report, shareholder holding, director holding, audit report etc. are required to be attached.

2. MGT-7: In MGST-7 the company is required to filled its annual return its includes detail like no meeting company held, director held, related party transaction etc.

3. ADT-1: Any appointment of company auditor is required to filled in form ADT-1

4. ADT-3: If any auditor resigns from organization they require to filled ADT-3.

5. DPT-3: If a company has taken loan from its director or any other person company is required to filled DPT-3 form

Apart from this there are some other form also which is required to be filled by the company depending upon the requirement.

Contact us

Documents Required

1. BOOKS OF ACCOUNT

We required books of account in accounting software like tally, busy etc.

ANNUAL returns annual REPORTs.

We required annual reports like board report , director report, minutes books etc.

3. CURRENT ACCOUNT STATEMENTS

we required current account statements of your company from 1April to 31 march.

4. GST RETURN DETAILS

If you are registered GST assesse then we required all your GST sales and purchase details.

Reasons for ANNUAL COMPLAINCE OF PRIVATE LIMITED

1. MANDATORY Requirement

It it mandatory for every private limited company to get there account audit and filled the same to ROC.

2. Easy to Start

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

3. Less documents required

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

4. Taxation benefits

For proprietorship registration we need Adhaar card of individual (Some time Voter ID may work ) for address of individual.

5. Less Compliances

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

6. Easy to exit

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

REGISTRATION PROCESS

Step-1

Single Owner

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

Step-2

Easy to Start

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

Step-3

Less documents required

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

Step-4

Taxation benefits

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

How Ovakil help with company annual filing Registration?

Ovakil helps you for company annual filing

1. Shop Establishment Registration

For proprietorship registration there are many type of registrations. Shop establishment one of them, the process of this registration is different in every state of India

2. GST Registration

This registration will take 2-3 days and GST registration is sufficient to open current account for business.

3. Udhyog Adhaar Registration

Udyog Aadhaar is a registration for all micro, small and medium sized businesses. This registration along with a GST registration can be used for opening of bank account.

FAQs

Every LLP needs to file an annual return in Form 11 with ROC, 60 days before the closure of financial year. The annual return is also available for public inspection once payment of prescribed fees is made to the Registrar.

The Annual return can be submitted by any of its directors but it shall be duly signed by both the directors of the Company and by the Manager or Company Secretary. There are certain cases when there is no Manager/ CS in a Company in such situations signature of both the directors are compulsory.

Form 11 is required to be filed by every LLP with the Registrar within 60days from the conclusion of the financial year i.e. the Annual Return.

Latest from the blog

Check In Which Class Your Trademark Is To Be Registered

Trademark registration that works to protects your business reputation and goodwill around the world. With the trademark; one can easily make his or her business

Some Reasons For Trademark Objections

Once a Trademark application is filed, a trademark examiner scrutinizes the application. This is done to make sure the application isn’t at odds with any trademark

Rules for Authorized Share Capital for Company Registration

Authorized Share Capital more commonly known as authorized capital is basically the maximum amount of share capital that a company can issue to shareholders. This amount

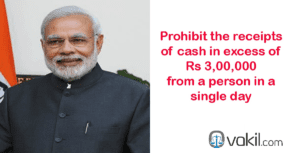

Transaction In Cash Above Rs 3 Lakhs Is Prohibited In India

From this budget a new Section 269ST is proposed to prohibit the receipts of cash in excess of Rs 3,00,000 from a person in a

Pre-Assessment Notice To Wrong Address of Assessee Will Not Render A Valid Notice

In CIT v. Abacus Distribution Systems (India) Pvt. Ltd, the Bombay High Court held that the issue of a notice under section 143(2) of the Income

Nidhi Company Registration process and list of documents required

Nidhi Company registration process isn’t extremely tough and not take much time to entire procedure. To continue with the idea of company, we like to give

PACKAGES

All over india services provider

Why to choose ovakil?

Faster services

We provide faster services, we had a team of professional who provide services to you 7 days a week.

free cousultancy

Our Team is just one call away to provide solutions to your all tax querries at free of cost.

team of CA, CS & LLB

We had a huge team of experienced Professionals CA,CS, LLB and Tech experts.

Lowest price

We provide our services to our costumers at lowest price in INDIA

We are Very Glad to Know Our Client Reviews