All about GST Registration Online

GST is the biggest game changer reform in India, for avoiding multiplicity of taxes in India, or enlarging tax base, government introduces GST in India by bringing in millions of small businesses in India. By multiple taxes into a single system, tax complexities would be reduced and government revenue on direct taxes has been increased sustainably. Under GST all the chain between manufacture to end consumer nobody has to pay the double tax or we can say anybody in chain pay GST only on the value added by him.

Further, registration under GST is mandatory once an entity crosses the turnover criteria as prescribed 20/40 lacs.

When required to take GST registration:

Entities in special category states: Entity having GST turnover of Rs.20 lacs and above would be required to obtain GST registration, special categories states are:

Special status of states under the GST Act is:

- Arunachal Pradesh

- Assam

- Jammu & Kashmir

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

- Uttarakhand

The Registration limit for the above states is 20 lakh.

Apart from these states the limit for GST registration in other states is 40 lacs

Contact us

Documents Required for gst registration

1. Pan Card

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

2. Aadhaar Card

Aadhar Card is required for GST registration.

3.Saving Bank Details

Bank account details is required for registration. We need Passbook first page and latest statement. Also provide us Bank account number, IFSC code and Branch name

4. Business address proof

Any utility bill like electricity bill or water tax bill is required, in case property is rented in than rent agreement with owner is required.

WHY GST Registration IS mandatory ?

1. Bank Account Opening

GST registration is helpful for current account opening for proprietorship and partnership firm as they don't have any other government issued document.

2.Turnover Criteria

Entities involved in supplying of goods or services with an annual aggregate turnover of more than Rs.40 lakhs in most States are required to obtain GST registration mandatory. In special category states, the aggregate turnover criteria has been reduced to Rs.20 lakhs.

3. Inter-State Supply

If an entity undertakes inter-state supply of goods and/or services, then GST registration must be obtained mandatory, irrespective of aggregate annual turnover. For example, if a business in Maharashtra supplies goods to a business in Tamil Nadu, then GST registration is required.

4. E-Commerce Sellers

Entities involved in the supply of goods or services through e-commerce platforms are mandatory required to obtain GST registration, irrespective of aggregate annual turnover. Hence, sellers on e-commerce platforms like Amazon, Flipkart and Snapdeal would have to register under GST mandatory.

5. Casual Taxable Persons

A casual taxable person is someone who occasionally undertakes supply of goods or services having no fixed place of business. An example of a casual taxable person can be a fireworks shops setup during Diwali festival time, selling fireworks or a temporary food stall.As stated in this article, you can browse your selection of available deals on smartphones and top brands and explore the cell phone service plans that best suit your needs.

REGISTRATION PROCESS

Step-1

Single Owner

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

Step-2

Easy to Start

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

Step-3

Less documents required

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

Step-4

Taxation benefits

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

How Ovakil help with Proprietorship Registration?

Ovakil helps you for registering Proprietorship business, it usually take 2-3 days for all process.

1. Shop Establishment Registration

For proprietorship registration there are many type of registrations. Shop establishment one of them, the process of this registration is different in every state of India

2. GST Registration

This registration will take 2-3 days and GST registration is sufficient to open current account for business.

3. Udhyog Adhaar Registration

Udyog Aadhaar is a registration for all micro, small and medium sized businesses. This registration along with a GST registration can be used for opening of bank account.

FAQs

It’s a totally based on online process all you need to submit the document to us, and there is no need of physical appearance, just forward your documents on our Mail ID

Yes, there is no restriction for taking more then one GST number. However you need to create different account for every registration.

Benefit of 20 lakh turnover is not available if you do sale outside the state in which your business is registered. Even if you make single sale, then you need to take registration in GST .

No annual charges are required for GST registration, this is one time process, however GST return to be file every month even if no sale done by you.

Scanned copy of all above documents is sufficent, you can upload the docs in your user login or directly mail us.

For GST of company , firm or LLP the registration will be on same name . But in case of proprietorship registration the name can be decided by the proprietor.

Latest from the blog

Check In Which Class Your Trademark Is To Be Registered

Trademark registration that works to protects your business reputation and goodwill around the world. With the trademark; one can easily make his or her business

Some Reasons For Trademark Objections

Once a Trademark application is filed, a trademark examiner scrutinizes the application. This is done to make sure the application isn’t at odds with any trademark

Rules for Authorized Share Capital for Company Registration

Authorized Share Capital more commonly known as authorized capital is basically the maximum amount of share capital that a company can issue to shareholders. This amount

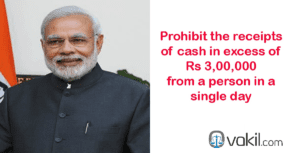

Transaction In Cash Above Rs 3 Lakhs Is Prohibited In India

From this budget a new Section 269ST is proposed to prohibit the receipts of cash in excess of Rs 3,00,000 from a person in a

Pre-Assessment Notice To Wrong Address of Assessee Will Not Render A Valid Notice

In CIT v. Abacus Distribution Systems (India) Pvt. Ltd, the Bombay High Court held that the issue of a notice under section 143(2) of the Income

Nidhi Company Registration process and list of documents required

Nidhi Company registration process isn’t extremely tough and not take much time to entire procedure. To continue with the idea of company, we like to give

PACKAGES

PLATINUM

all inclusive fees-

GST Registration

-

Expert Advice

-

MSME Registration

All over india services provider

Why to choose ovakil?

Faster services

We provide faster services, we had a team of professional who provide services to you 7 days a week.

free cousultancy

Our Team is just one call away to provide solutions to your all tax querries at free of cost.

team of CA, CS & LLB

We had a huge team of experienced Professionals CA,CS, LLB and Tech experts.

Lowest price

We provide our services to our costumers at lowest price in INDIA

We are Very Glad to Know Our Client Reviews