All about Limited import export code Registration

Import Export Code (IMPORT EXPORT CODE) is required by every person for executing any transaction out of India. Without Import export code we cannot do any transaction from foreign country. By forwarding any sale to foreign country some benefits received in GST and other laws.

In India Directorate General of Foreign Trade (DGFT) issue IMPORT EXPORT CODE registration to business entity. After submitting all documents to department it will take 3 working days for certificate. As per Directorate General of Foreign Trade (DGFT) you need to update your import export code every year

Understanding of IMPORT EXPORT CODE registration

- Required by Importer

Every importer needs IMPORT EXPORT CERTIFICATE or any import from other country. There is no minimum limit for any importer to get IMPORT EXPORT CODE. We need IMPORT EXPORT CODE from first export. It is important for custom department and banking transaction.

- No Monthly Returns

IMPORT EXPORT CODE does not require any monthly or annual return filing. Obtaining IMPORT EXPORT CODE is one time process, after that there is no other requirement from department.

- Lifetime Validity

No renewal is required in IMPORT EXPORT CODE; there is only one time registration process. Once IMPORT EXPORT CODE received then it can be used for all import export. However you need to update your import export code every year

- Required be Exporter

Every exporter need IMPORT EXPORT CODE for any export to other country. There is no minimum limit for any exporter to get IMPORT EXPORT CODE. We need IMPORT EXPORT CODE from first export. It is impotent for custom department and banking transaction.

- PAN Based

IMPORT EXPORT CODE registration is PAN based registration, which means every partnership, company and proprietor will have separate IMPORT EXPORT CODE code.

Contact us

Documents Required for iec registration

1. Pan Card & picture

Individual PAN card & picture is required for registration. In proprietorship no separate PAN card will applied.

2. Aadhaar Card

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

3. Saving Bank Details

Bank account details is required for registration. We need Passbook first page and latest statement. Also provide us Bank account number, IFSC code and Branch name

4. Business address proof

For business address proof we need Electricity bill, rent agreement or any other government utility bill

Reasons for import export code (IEC) registration

1. TAXATION BENEFITS

If you are having IEC code then you can exports and goods without payment of taxes.

2. DUTY DRAWBACK

If you already paid taxes in the form GST on export of goods and services then you can claim duty drawback (i.e. the taxes you paid on taxes)

3. Manditory requirement

In India its a mandatory requirement that you cant export and import of goods/ services until you don't have IEC code.

4. No annual return required

IEC holder doesn't required any monthly or annual return however you have to verify your IEC code every year.

6. International reachabililty

Dur to IEC you can sell anywhere in the world by having IEC, you can export your goods/ services to any country.

REGISTRATION PROCESS of iec

Step-1

Expert call

Our executive will call you to understand your business and requiremnets

Step-2

documents collection

Our executive will collect all the documents required for IEC code

Step-3

Documents submission

After collecting all the documents our executive will filled the application

Step-4

Certificate

This is the last step you will your certificate with in 2-3 days after submission of documents.

How Ovakil help with IMPORT EXPORT CODE/Registration?

Ovakil helps you for registering Import export code , it usually take 2-3 days for all process.

1. IMPORT EXPORT REGISTRATION

OVAKIL HELPS YOU TO GET NEW IMPORT EXPORT CODE CERTIFICATE

2. REQUIRED DOCUMENTS

OVAKIL HELPS YOU TO CREATE ALL NECESSARY DOCUMENTS FOR IEC CERTIFICATION

3. EXPERT ADVICE

OVAKIL PROVIDE YOU EXPERT ADVICE FROM EXPERIENCED PROFESSIONALS

FAQs

It will take 2 working days for all process after full documents submission to department.

NO, THERE IS NO NEED OF PHYSICAL VERIFICATION REQUIRED FOR IMPORT EXPORT CODE CERTIFICATE, ONLY DOCUMENT VERIFICATION IS SUFFICIENT BEFORE GRANTING CERTIFICATE

YES, WEATHER YOU ARE MANUFACTURER OR SERVICE SECTOR YOU CANNOT EXPORT YOUR GOODS AND SERVICE BEFORE GETTING IMPORT EXPORT CODE CERTIFICATE

THERE IS NO REQUIREMENT OF RENEWAL OR ANY COMPLIANCE FOR IMPORT EXPORT CODE CERTIFICATE; HOWEVER YOU NEED TO UPDATE IMPORT EXPORT CODE EVERY YEAR.

Latest from the blog

Check In Which Class Your Trademark Is To Be Registered

Trademark registration that works to protects your business reputation and goodwill around the world. With the trademark; one can easily make his or her business

Some Reasons For Trademark Objections

Once a Trademark application is filed, a trademark examiner scrutinizes the application. This is done to make sure the application isn’t at odds with any trademark

Rules for Authorized Share Capital for Company Registration

Authorized Share Capital more commonly known as authorized capital is basically the maximum amount of share capital that a company can issue to shareholders. This amount

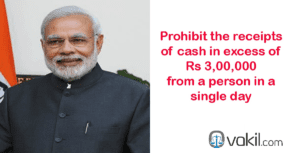

Transaction In Cash Above Rs 3 Lakhs Is Prohibited In India

From this budget a new Section 269ST is proposed to prohibit the receipts of cash in excess of Rs 3,00,000 from a person in a

Pre-Assessment Notice To Wrong Address of Assessee Will Not Render A Valid Notice

In CIT v. Abacus Distribution Systems (India) Pvt. Ltd, the Bombay High Court held that the issue of a notice under section 143(2) of the Income

Nidhi Company Registration process and list of documents required

Nidhi Company registration process isn’t extremely tough and not take much time to entire procedure. To continue with the idea of company, we like to give

PACKAGES

sILVER

all inclusive fees-

IMPORT EXPORT CODE

-

1 DSC IF REQUIRED

-

EXPERT ADVICE

-

MSME REGISTRATION

-

GST REGISTRATION

GOLD

all inclusive fees-

IMPORT EXPORT CODE

-

1 DSC IF REQUIRED

-

MSME REGISTRATION

-

EXPERT ADVICE

-

GST REGISTRATION

Platinum

all inclusive fees-

IMPORT EXPORT CODE

-

1 DSC IF REQUIRED

-

MSME REGISTRATION

-

MSME REGISTRATION

-

GST REGISTRATION

All over india services provider

Why to choose ovakil?

Faster services

We provide faster services, we had a team of professional who provide services to you 7 days a week.

free cousultancy

Our Team is just one call away to provide solutions to your all tax querries at free of cost.

team of CA, CS & LLB

We had a huge team of experienced Professionals CA,CS, LLB and Tech experts.

Lowest price

We provide our services to our costumers at lowest price in INDIA

We are Very Glad to Know Our Client Reviews