All about Proprietorship Registration

Proprietorship Registration

Sole proprietorship is most popular form of business one can run it is less costly, easy to make and its also had a advantage of less compliance to follow, Legally a sole proprietor and his business are seen as same legal entity. The single person is the owner of the entity as well as they are liable for the liabilities occurred in the business personally. A sole proprietorship can operate under the any name by his name itself or under the another name like we see in traditional market proprietor run business in the name of God and Goddess like Maa Laxmi, Shiv, Ganesh etc.

Th fictitious name will be your Brand name under which an organization are working for example Paytm is a brand name of one97 communication private limited, here organization name one97 communication private limited but their brand names Paytm.

The sole proprietorship is a popular business form because of its nature easy to start and less compliance form of business

- GST Registration: This is most popular form of sole Proprietorship registration under this you will have pay GST taxes once you get your registration.

- MEME Registration/ Udhyog Adhar: MSME is a simplest and easy way to register your Sole proprietorship firm, unlike GST registration which required to pay taxes on their sale and filled monthly return, there is no such legal compliance required in MSME registration

- Shop and Establishment: A sole proprietor can take registration under shop and establishment you can registered your firm under the act, from 1 to 5 years at a time after which there is a requirement to get their license renewal

However, one of the disadvantages is that the owner of a sole proprietorship remains personally liable for all the business’s debts. So if there is any liability arise in the business the sole proprietor is personally liable for all the debt of business.

Contact us

Documents Required for sole propritorship registration

1. Pan Card

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

2. Aadhaar Card

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

3. Saving Bank Details

Bank account details is required for registration. We need Passbook first page and latest statement. Also provide us Bank account number, IFSC code and Branch name

4. Business address proof

For business address proof we need Electricity bill, rent agreement or any other government utility bill

Reasons for Sole Proprietorship

1. Single Owner

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

2. Easy to Start

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

3. Less documents required

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

4. Taxation benefits

For proprietorship registration we need Adhaar card of individual (Some time Voter ID may work ) for address of individual.

5. Less Compliances

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

6. Easy to exit

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

REGISTRATION PROCESS

Step-1

Single Owner

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

Step-2

Easy to Start

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

Step-3

Less documents required

Individual PAN card is required for registration. In proprietorship no separate PAN card will applied.

Step-4

Taxation benefits

For proprietorship registration we need Adhaar card of individual ( Some time Voter ID may work ) for address of individual.

How Ovakil help with Proprietorship Registration?

Ovakil helps you for registering Proprietorship business, it usually take 2-3 days for all process.

1. Shop Establishment Registration

For proprietorship registration there are many type of registrations. Shop establishment one of them, the process of this registration is different in every state of India

2. GST Registration

This registration will take 2-3 days and GST registration is sufficient to open current account for business.

3. Udhyog Adhaar Registration

Udyog Aadhaar is a registration for all micro, small and medium sized businesses. This registration along with a GST registration can be used for opening of bank account.

FAQs

Any Indian citizen can start a sole proprietor firm simply by having a pan card and one current account.

All you need one pan card and one current account, Opening a current account you need one government registration it can be service tax registration, vat registration, shop or factory act registration.

A sole proprietorship business generally require 2-3 days to form an entity it includes any government registrations if any.

Mostly small business is run in sole proprietorship, like retailer, traders, small manufactures, but for big business, Proprietorship is not concerned good option.

Yes you always have an option to convert your sole proprietorship in to company simply by contact us and we only require documents for converting in to company.

Latest from the blog

Check In Which Class Your Trademark Is To Be Registered

Trademark registration that works to protects your business reputation and goodwill around the world. With the trademark; one can easily make his or her business

Some Reasons For Trademark Objections

Once a Trademark application is filed, a trademark examiner scrutinizes the application. This is done to make sure the application isn’t at odds with any trademark

Rules for Authorized Share Capital for Company Registration

Authorized Share Capital more commonly known as authorized capital is basically the maximum amount of share capital that a company can issue to shareholders. This amount

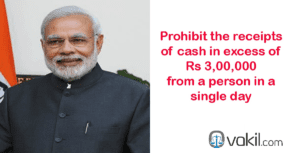

Transaction In Cash Above Rs 3 Lakhs Is Prohibited In India

From this budget a new Section 269ST is proposed to prohibit the receipts of cash in excess of Rs 3,00,000 from a person in a

Pre-Assessment Notice To Wrong Address of Assessee Will Not Render A Valid Notice

In CIT v. Abacus Distribution Systems (India) Pvt. Ltd, the Bombay High Court held that the issue of a notice under section 143(2) of the Income

Nidhi Company Registration process and list of documents required

Nidhi Company registration process isn’t extremely tough and not take much time to entire procedure. To continue with the idea of company, we like to give

PACKAGES

sILVER

all inclusive fees-

PAN CARD

-

GST REGISTRATION

-

MSME REGISTRATION

-

EXPERT ADVICE

-

ISO CERTIFICATION (1 YEAR)

-

TRADEMARK GEGISTRATION

GOLD

all inclusive fees-

PAN CARD

-

GST REGISTRATION

-

MSME REGISTRATION

-

ISO CERTIFICATION (1 YEAR)

-

EXPERT ADVICE

-

TRADEMARK REGISTRATION

Platinum

all inclusive fees-

PAN CARD

-

GST REGISTARTION

-

MSME REGISTARTION

-

ISO CERTIFICATION (1 YEAR)

-

TRADEMARK REGISTRATION

-

EXPERT ADVICE

All over india services provider

Why to choose ovakil?

Faster services

We provide faster services, we had a team of professional who provide services to you 7 days a week.

free cousultancy

Our Team is just one call away to provide solutions to your all tax querries at free of cost.

team of CA, CS & LLB

We had a huge team of experienced Professionals CA,CS, LLB and Tech experts.

Lowest price

We provide our services to our costumers at lowest price in INDIA

We are Very Glad to Know Our Client Reviews